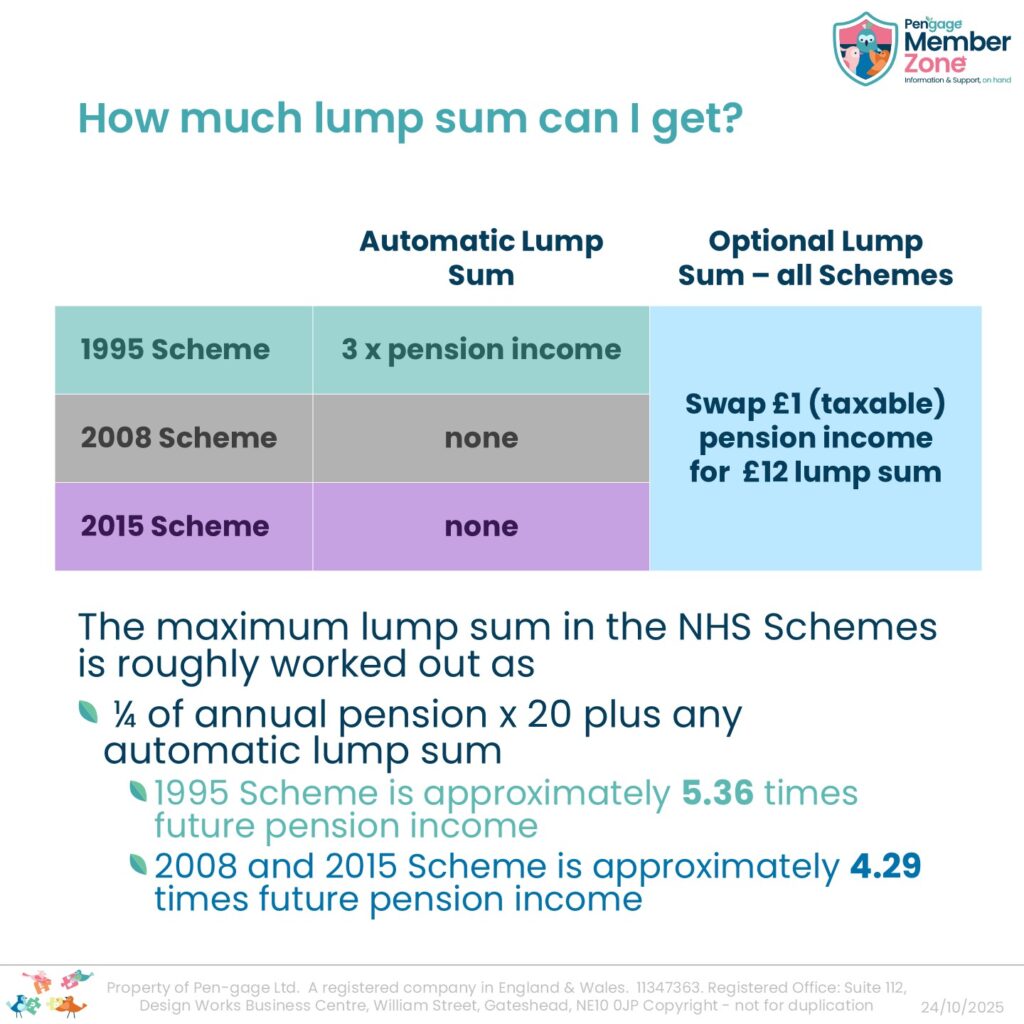

HMRC set a maximum lump sum (one-off cash payment) you can take from your pension benefits, the lower of:

• 25% of the available Lifetime Allowance

• 25% of the Capital Value of your pension

The Capital Value of a Defined Benefit scheme, like the NHS schemes, is a multiple of the annual pension