Remedial Pension Savings Statements (RPSS) Service

The McCloud/Remedy Rollback means all Annual Allowance calculations have had to be re-worked – Remedial Pension Savings Statements are landing on doormats and need checking with HMRC for tax implications

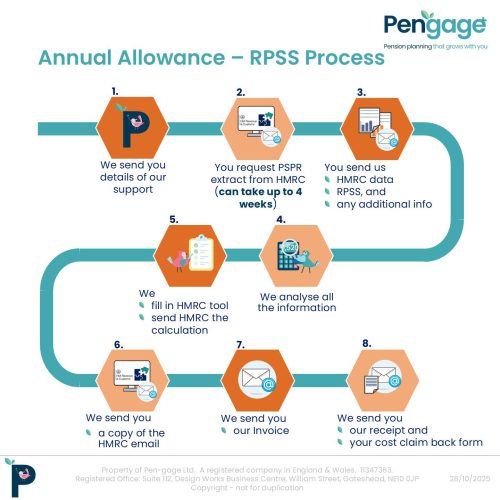

We will

- analyse your individual figures to calculate the old and revised Annual Allowance position for any tax charges

- complete the HMRC submission as your agent

- send you a copy of the submission results

- send you a receipt for you to reclaim the cost of our service (£825 + VAT) under the NHS* Cost Claim Back process which covers costs up to £1,000

*Other Schemes have other Cost Claim Back limits so check the limit for your Scheme

Reviews are not financial advice. We cannot advise which options to take.