In 2015 Public Sector pension schemes introduced a new section to their pension scheme structure – all have different names but work in a similar way (2015, alpha, CARE etc). When these schemes were originally introduced not everyone was treated the same. Scheme members were or were not moved into the new section based on how close they were to their normal pension age.

This has since been found through the Court of Appeal to be age discrimination and HM Treasury must now implement a remedy to address this. This is known informally as the McCloud ruling or remedy – named after Judge McCloud who raised one of the legal challenges.

More formally this remedy is referred to as The Public Service (Civil Servants and Others) Pensions (Remediable Service) Regulations 2023.

What does it mean for me?

It very much depends on your circumstances. However, if you were a member of a public sector pension scheme as at April 2012 and continued to have pension membership after April 2015 then this remedy is likely to affect you.

In order to remove the age discrimination, HM Treasury have introduced new legislation – some of this is retrospective and some is forward looking.

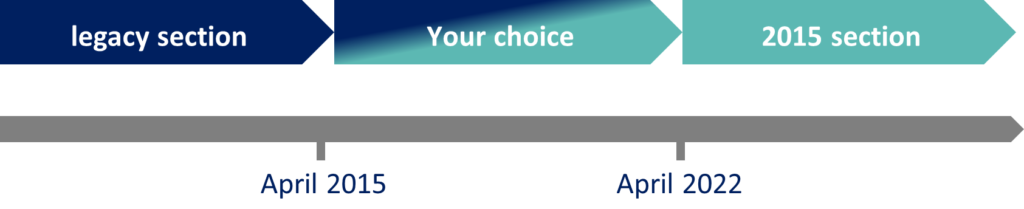

As a result, from April 2022, members of the pension scheme who were active scheme members as of 1 April 2012 will be put back into their original scheme (known as the legacy scheme) with effect from 1 April 2015. This is a retrospective change. All active scheme members (as at 01/04/2012) have now been moved into the 2015 section with effect from 1 April 2022.

At retirement members will then choose how they wish their pension to be calculated for the period from 1 April 2015 – 31 March 2022. In other words, they can elect for the legacy scheme basis or the 2015 scheme basis. At retirement, figures should be available so that members can make the choice based on complete and accurate information, allowing them to select the more favourable option for their circumstances.

For most, this therefore means there is no action to take at the moment. The schemes will make these changes throughout 2023/2024 and you will be issued with new pension statements (called Remedial Service Statements) which will show the new position. Each scheme has a slightly different timeframe for when these statements will be issued. Please check on your pension scheme website.

What about the Annual Allowance?

The Annual Allowance is the limit on the tax free amount of pension savings someone can have in a tax year. If you exceed this allowance there can be a pensions tax charge to manage.

The majority of people will not be aware of or exceed this allowance and so even with these changes they will remain unaffected.

However, if you are a higher earner or have had previous Annual Allowance assessments to undertake in any tax year between 2015/16 and 2021/22, and you were moved into the new section before 01/04/2022, then the rollback will mean that the previous pensions savings growth figures will now be incorrect and will have to be recalculated. This could mean that the amount of pensions annual allowance tax that you have paid – either directly or through the scheme pays arrangement – will need to be recalculated and adjusted accordingly.

The expectation is that revised calculations will be provided from the pension schemes to confirm the new pension growth amounts and individuals will then need to revisit their original position to determine any changes. We expect these figures to be provided in 2024 with a deadline date of October.

HMRC and the pension schemes will need to be notified of the amended position for the remedy period. HMRC will be producing an online calculator and form submission process. No Annual Allowance amendments should be made through the self-assessment process for the remedy period.

Each public sector pension scheme will determine any potential compensation eligibility in respect of costs incurred to the individual as a result of the McCloud remedy.

How we can help

At Pen-gage we work right across the public sector pension schemes helping individuals to understand and model their own pension position. Over the last 12 months we have been providing estimated McCloud remedy figures and retirement modelling. We work with our existing clients to help understand their Annual Allowance position and provide support and guidance with any actions required.

We can provide support with pensions modelling, forecasting and scenario planning for all scheme members, to help them to understand the options available to them at retirement and the impact the McCloud remedy may have on their benefits.

We understand that pensions tax and dealing with HMRC can be a confusing and anxiety inducing process, we will be continuing to work with our clients and support them through the application of the McCloud remedy – including any revised calculations, submissions and guidance.

Contact us

Please use this form to make contact with us.

Compensation for adviser fees

We understand that there may be certain circumstances where adviser fees can be reclaimed in some form from the pension scheme, if an individual has needed to obtain paid for guidance or support as a result of the remedy. The requirements, threshold and processes for this are not yet known.

What do you do now

At the moment nothing, keep checking back on your pension scheme website and correspondence. If you feel you would like some wider pensions support or to find out a bit more then please contact us using this form.

We also have a Facebook group which may help you with some general issues.

McCloud FAQs

What do I need to do now?

Nothing. We appreciate that you will want as much information as possible, especially if you are approaching retirement, however, the pension schemes have a significant amount of work to undertake to implement these changes and will contact you in due course with any decisions that you might need to make.

I stopped my Added Years because of the 2015 scheme – can I reinstate them?

Yes, there should be an option to look at reinstating these.

I opted out of the pension scheme because of issues with the 2015 (remedy) scheme – including annual allowance issues – I would not have made this decision if I could have stayed in my legacy scheme, what can I do?

You may be able to opt back in retrospectively, this is called a contingent decision. You will, at the relevant time, need to raise a contingent decision case with your pension scheme for them to consider the position. If they are satisfied that you would not have opted out has you not been moved into the new section they may allow you to rejoin the scheme retrospectively. You will be required to pay any member contributions for the opt out period and so this is any area in should look at carefully.

I have paid additional contributions into the 2015 section – as additional pension or an early retirement buy out arrangement – what happens to these contributions?

You will receive communications from your pension scheme about this in due course. Your additional pension contributions will be reverted to your legacy scheme and purchase additional pension within this section. Early retirement buy outs are bit more complex and the legacy schemes do not have a similar arrangement. There will be a few options potentially available to you including converting these contributions to additional pension in the legacy scheme, receiving a refund or deferring your decision until you reach retirement when you know which option you will be taking. Each public sector scheme is dealing with the buy out position slightly differently so check in with you scheme website for more information.

I have had previous annual allowance charges, will these now all need to be recalculated?

If you were a member who was originally moved into the new 2015 section before 01/04/2022 and had an annual allowance charge for any of the tax years between 2015/16 and 2021/22 then yes these will need revisiting.

As the membership of the 2015 sections is being reversed for the period from 2015 -2022 this means that the rate that your pension has grown will have changed for these years. In many cases the expectation is that the Annual Allowance charge will come down, but, depending on circumstances it may go up – this will be because of the overall pension benefits have increased.

Due to HMRC legislation not all tax years are ‘in scope’ – which means they are too old to revisit in full. The years which are out of scope currently are 2015/16, 2016/17, 2017/18 and 2018/19.

If you have a revised pensions tax charge for either of these years and the annual allowance tax has gone down, you can reclaim this. If the tax has increased for any of these years then no additional tax will be payable.

For the remaining tax years 2019/20,2020/21 and 2021/22 any under or overpaid tax will need to be settled/ managed accordingly. HMRC will be providing an online tool/ form to help with this, there will be no requirement to resubmit self-assessments for the affected tax years.

If I opted out for an ‘out of scope’ tax year and now opt back in again, does this mean I will not have an Annual Allowance charge to pay for that year?

Yes, assuming the scheme is satisfied by your reason for opting out and now wishing to retrospectively rejoin, if this is for one of the out of scope years (see point above) then we believe that there would be no Annual Allowance charge triggered as a result of this action.

I am retiring in the next 6 months, will I get both options when I retire?

It depends on the public sector scheme that you are a member of. All schemes are working really hard to implement these changes, but they are significant and many hundreds of thousands of cases will need to be revisited and this all takes time. Some of the schemes are able to provide both options from October 2023 but for some the options will come a bit later in 2024. You can retire now on the roll back position (the service from 2015 -2022 is in the legacy scheme) and then the secondary choice will be provided retrospectively. You can therefore make your plans based on the current estimates. You are unlikely to choose the second choice if the benefits it provides are going to reduce. But this does need to be looked at carefully.

I know that I will want my pension to be calculated with the 2015 -2022 pension benefits being in my legacy scheme – why do I need a choice?

How do you know this? There is often an assumption that the additional service in the legacy scheme will provide a better outcome for people. And it might. But it also might not. This is very much based on circumstances and is unique to each individual.

Often we see that because the legacy scheme can come with a standard lump sum amount in addition to the pension or because it has an earlier normal pension age to the more recent schemes that there is an automatic assumption that this will be the better option. It really is not the case. The benefits in the new sections grow quicker year on year than the earlier sections and are inflation linked. They will attract an early retirement reduction for taking them early but they potentially have grown much quicker than the legacy scheme. You can also exchange pension for cash. Death benefits for dependants are also different across the sections.

This is why a choice is being offered. This is why it is really important to interrogate and understand the options available to you. It can feel complex and challenging and you may need to get external support if you need to but this could add hundreds of pounds per annum to your pension. Your pension is likely to be your first or second biggest asset so you need to learn to love it and give it time it deserves!

I cannot tell if my pension record is correct – what do I do?

100% you need to look at this. The pension record is what determines the amount of pension benefits you receive. If this is incorrect or has something missing, you could be missing out on pension benefits. Similar if pension benefits are overstated then you would have to pay them back!

Check you pay and check your service. You can ask your scheme for a service statement which will provide a breakdown of your service since you joined the scheme. This is super important, McCloud or no McCloud

Can you help me?

If you feel you need some help to pick through you options, pensions modelling and scenario planning, we can help.

If you have Annual Allowance issues and are now impacted by the remedy, we can help.

If you think you have a contingent decision around opting out and now wanting to come back in , we can also help.

These are all big decisions and it is important if you need support that you have access to that through experts in the public sector pension schemes.

Please contact us or visit our Facebook page.