We are pleased to announce a new series of guest articles on the latest news, challenges, and opportunities in the pensions arena.

Our first article is by Yasmin Andrews of BWD Search & Selection. It covers the growth, challenges, and future prospects of the Professional Trustee industry.

The rapid growth of Professional Trustee (PT) Firms has been accelerated in recent years by the increasing appointments of Professional Independent Trustees to the trustee boards of UK pension schemes, particularly on larger schemes. Driven by the need to streamline processes and to cope with the ever-increasing governance burden, PT firms’ ability to provide a more efficient service is seeing them increasingly responsible for solely running pension schemes, both large and small.

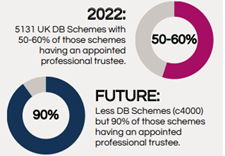

As illustrated in Isio’s Independent Trustee Survey 2022, it is estimated that 50% of pension schemes have appointed a professional trustee in some capacity – either as Chair, Co-Trustee or Sole Trustee. The year of 2021 saw the total PT appointments rise to over 2,000 across the 13 PT firms participating in the survey, generating a 20% average increase in revenue and £1.2bn increases in assets under governance.

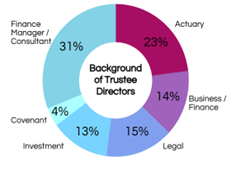

The survey also shows the range of backgrounds in which the trustee representatives are from, with a background as a Pension Manager or Consultant making up 31%, and another 23% coming from actuarial backgrounds. The remainder consists of lawyers, investment specialists, covenant advisors, and wider financial or treasury backgrounds. As PT firms grow in numbers, influence, and expertise, they are gaining more responsibility in running the pension fund.

Although the above suggests that PT firms are growing, it has been argued that PT firms may be facing a retention crisis. According to research by Charles Stanley, 40% of professional trustees plan to step down from their roles within the next 7-11 months, and a further 40% plan to step down within three years. While this may seem concerning at first glance, the reasons that trustees are stepping down is mainly due to retirement (35%) or reaching the end of their tenure (27%). This in turn sparks an exciting new influx of talent, especially that of a more diverse nature than before.

Research commissioned by Cardano found that PT firms are more diverse in respect of age and gender compared to traditional pension trustee boards. Trustee boards on average remain predominately male and over the age of 45, while over a third of PT firm respondents stated that more than 40% of their trustees are female. With more than half of PT firms conducting diversity and inclusion training to improve their diversity, equality and inclusion (DEI), they are seen to access wider perspectives and prevent lack of representation, therefore delivering better outcomes and governance for members. Through playing a significant role in improving their DEI, PT firms continue to become a more attractive place to both work for, and work with.

However, the number of those schemes that currently have professional trustees appointed in some capacity is predicted to rise from around 50% to 90% within the next five years. To put this into perspective, if the number of DB schemes continues to fall but the number of those schemes with a professional trustee continues to rise, the total number of professional trustee appointments required will still increase significantly regardless of the change in the number of schemes.

Over 43% of pension schemes have a professional trustee and one third of those are sole trustee arrangements. 2022 saw a 20% increase in sole trustee appointments, and this increased demand reflects the more efficient model presented by sole trusteeship. Sole trusteeship meets the need for more simple governance, managing buy-ins and buy-outs, endgame planning, quicker decision making and cost savings. This has led to a large recruitment drive in many professional trustee firms to ensure that their services continue to be delivered efficiently as the number of appointments and responsibilities continues to rise.

In recent news, Ross Trustees and Independent Trustee Services (ITS) have merged to launch Independent Governance Group (IGG). With 437 appointments and more than £340bn of assets under governance, IGG is now one of the UK’s largest pension trustee and governance firm (see comparison below). This follows Zedra’s acquisition of PTL in January 2022 and, just like the shrinking DB schemes and rising professional trustee appointments, whilst the number of individual PT firms is expected to reduce from 12 to 6-8 over the coming years as a result of mergers and acquisitions, we can anticipate a further recruitment drive to increase the number of Professional Trustees.

BWD work with some of the largest professional trustee firms. If you are interested in exploring opportunities in this space, learning more about the market or have suggestions for the topic of my next article, please do get in touch.

Yasmin Andrews

Assistant Consultant at BWD Search & Select

0113 426 0773

Yasmin.andrews@bwd-search.co.uk