A two-minute guide for HR Directors / Heads of Reward.

The CIPD’s 2021 Health & Wellbeing at Work survey was published last month. Amongst its findings were that despite the increased focus on people’s mental health, employers need to do to more to support their employees’ financial wellbeing.

Most employers recognise the moral and business case – money worries affect our mental and physical health, which in turn can affect work performance. Even small employers with a limited budget can do their bit. But it requires some thought.

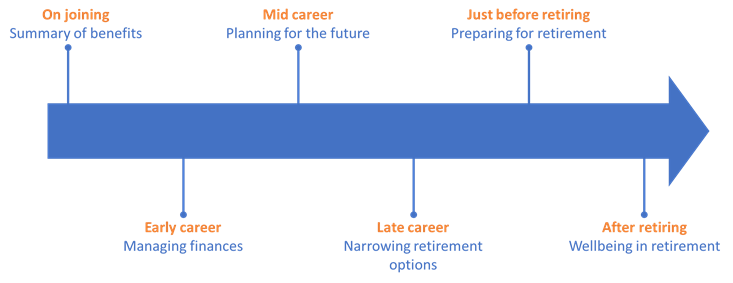

It might be tempting to draw up a financial wellbeing strategy around the typical career journey an individual employee makes, summarised below. You may have seen diagrams similar to this before.

However, few employees will remain with the same employer to the end of this journey. They’ll also have key life events the employer won’t know about and therefore can’t support.

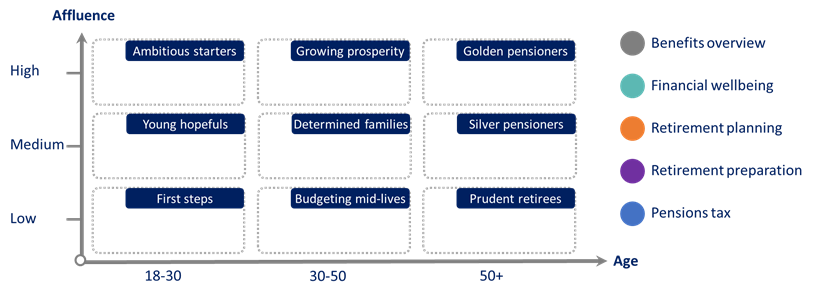

So, a wellbeing strategy should be more tailored. And this is possible even with a limited budget. We’ve had success in helping employers carry out some simple mapping using a matrix as per the diagram below. We then add the targeted webinars from the right-hand column in to the matrix to design their strategy. Webinars can be scheduled based on the frequency required which is determined based on the numbers within each segment.

Simple and effective. Please get in touch to discuss how we could help you with something similar.